- #Open payroll taxes new company in quickbooks desktop 2019 how to

- #Open payroll taxes new company in quickbooks desktop 2019 manual

- #Open payroll taxes new company in quickbooks desktop 2019 pro

- #Open payroll taxes new company in quickbooks desktop 2019 series

Tuesdays at the Chico center, 2480 Notre Dame Blvd.

#Open payroll taxes new company in quickbooks desktop 2019 series

13-27: QuickBooks Desktop Series will offer insight into QuickBooks through the Small Business Development Center. Topics include financial statements, cash flow cycle, financial ratios, troubleshooting, pricing and costs, forecasts and budgets.Īug. Reservations: 895-9017 or The series is designed to help owners manage their business financials. Cost: free, sponsored by Wells Fargo Bank, but must register. Thursdays at the center, 2480 Notre Dame Blvd., Chico. 8: “Financial Management for Existing Businesses” will be offered by the Small Business Development Center at Butte College. Topics include legal requirements, market and cost analysis, funding, business plans.Īug. Reservations: 895-9017 or The four-part series provides information for those starting a new business or already a small business owner. Wednesdays at the center, 2480 Notre Dame Blvd. 7-28: The New Venture Entrepreneurial Workshop series for start-up or new businesses will be presented by the Small Business Development Center at Butte College. The trainer is a CPA and QuickBooks ProAdvisor with payroll expertise.Īug.

#Open payroll taxes new company in quickbooks desktop 2019 manual

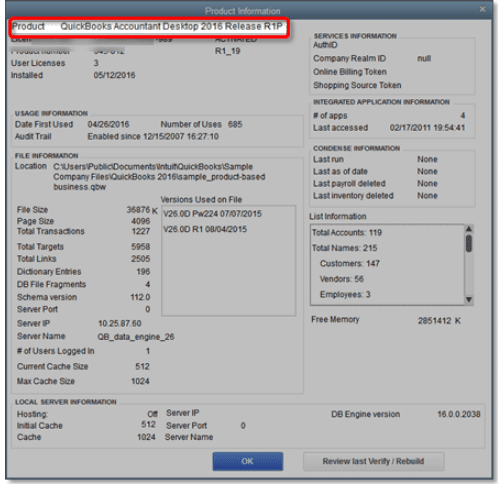

A QuickBooks payroll manual and handout are included. Examples of processing payroll functions using QuickBooks will be provided, including discussion of e-filing payroll taxes and forms out of QuickBooks. Reservations: 895-9017 or Topics include state and federal laws regarding business payroll function and record keeping to comply. 6: “Understanding Payroll - Payroll Taxes, Records and Functions in QuickBooks” will be offered 9 a.m. The 2019 QuickBooks Desktop version will be demonstrated, as well as the QuickBooks Online “test drive” using Chrome.Īug. Cost: free but must register: 895-9017 or The one-hour seminar reviews the reatures of both, and focus on Intuit’s comparative online tools with open discussion. 1: “QuickBooks Online or Desktop” will be offered by the Small Business Development Center at Butte College.

#Open payroll taxes new company in quickbooks desktop 2019 how to

Take a look at this video on how to pay bills online with QuickBooks Desktop.Aug. Once the payment is processed, QuickBooks marks the bill as paid, for visual confirmation. Vendor payment details are securely recorded with Melio and not in the QuickBooks Desktop Company file. Separately, they can choose how their vendor will receive the payment - as a deposit in their bank account (ACH) or as a paper check. QuickBooks users can choose to pay their vendor bills by ACH, debit or credit card. Assign a specific day for the payment to be processed and sent.

Optionally, on demand, users can select Sync Online Bill Payments from the menu bar to sync these details with the QuickBooks Company file.įeatures: Users can schedule vendor payments online from within QuickBooks. As the charges are deducted from your funding source, QuickBooks will record the fee bill as paid. Note: If paying a vendor bill with a payment type that includes a separate processing fee, QuickBooks will create a vendor named Melio, and these charges will be added as a vendor bill. Optionally, from a displayed vendor bill, select Schedule Online Payment from the top right of the main ribbon. How to find it: From the menu bar, select Vendors > Pay Bills.

#Open payroll taxes new company in quickbooks desktop 2019 pro

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0.

0 kommentar(er)

0 kommentar(er)